Women Micro-Entrepreneurs

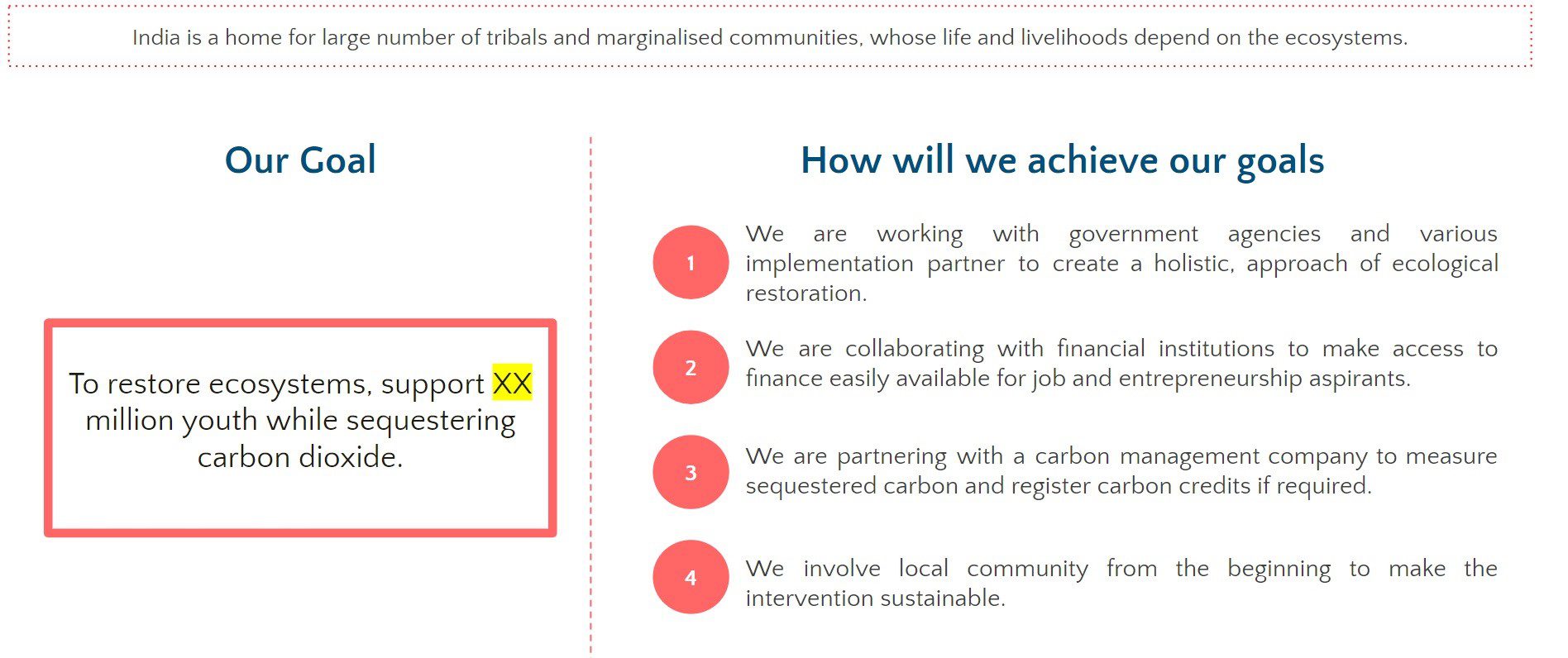

COVID – 19 has disproportionately affected women, owing to the compounded effect of generally earning less, saving less and holding more insecure jobs. While women’s participation in the labour force has been in steady decline for more than a decade, the livelihood impact of the pandemic has put 4 out of 10 women out of the workforce. In addition, their situation is made much more complicated by additional factors. One of the major issues is that poorer women entrepreneurs face significant barriers to accessing livelihoods assistance and capital due to factors such as little or no credit history, lack of collateral, etc.

Despite women entrepreneurs’ excellent repayment records when running micro–businesses, they are not often graduated to larger individual or business loans beyond microfinance programs. Thus the share of women served declines as microfinance institutions diversify or transform into banks. Women are less conspicuous in programs with larger loan sizes that could support higher levels of business development.

Financial institutions can proactively and profitably engage with women entrepreneurs as clients. Reports demonstrate successes where this has been achieved in ways that benefit both the creditors and their expanded female clientele. Understanding the depth of the problem, REVIVE was built to offer comprehensive solutions by partnering with three different organisations: Arthimpact Digital Loans, SEWA, and Chaitanya.

One of the areas of its focus has been on providing returnable grants to 569 micro-entrepreneurs in the customer network of Arthimpact Digital Loans (Arth), an NBFC which provides collateral-free credit solutions to small enterprises, farmers and micro-entrepreneurs. 96% of the cohort supported by REVIVE are women entrepreneurs engaged in a wide range of occupations including agriculture, dairy, handicrafts, catering and small restaurants, tailoring, grocery stores, e – rickshaws among others. They are spread out over 7 districts in Uttar Pradesh, Haryana and Rajasthan.

Depending on their needs, the entrepreneurs were provided with either of:

- Zero-cost working capital support in the form of a returnable grant of INR 20,000 / 30,000 over a 1-year tenure or

- For entrepreneurs requiring bridge financing during the devastating second wave of the COVID – 19 pandemic, zero-cost working capital support in the form of RG of INR 5,000 over 9 months but with a generous deferment period of 3 months

Another area of interest to REVIVE were initiatives of SEWA: RUDI – Rural Distribution Initiative, a production company owned and managed by small-scale women farmers, and Kamala, a food joint, providing nutritious dishes to its customers using millets and fresh produce procured directly from farmers. As the pandemic soared, the sales at both RUDI and Kamla sharply fell. The only way to revive the situation was by providing working capital to the entities to resume/accelerate the business operations. In view of the situation, Samhita/CGF supported SEWA in setting up the ‘Livelihood Recovery and Resilience Fund’: a returnable grant of INR 25,42,373 lakhs (after TDS deduction) to support the end-to-end production process of RUDI and Kamala.

In addition, REVIVE is currently working with Chaitanya India, an organization at the forefront of the micro-credit movement for underserved women to provide affordable finance in the form of zero-cost returnable grants to 125 women in Vasai and Mankhurd areas of Mumbai. The women are engaged in a series of occupations from fruit/vegetable vending and selling fish (Vasai) to beauty services, tailoring, jewelry making, snack making, etc. (Mankhurd). The women have received access to finance amounting to INR 15,000 / 20,000 depending on their occupations and would have to repay on a monthly basis over one year. Chaitanya India’s model for financial support is actioned through a strong grassroots network of SHGs and clusters which are federated to provide financial services and training.