Entrepreneurs with Disabilities

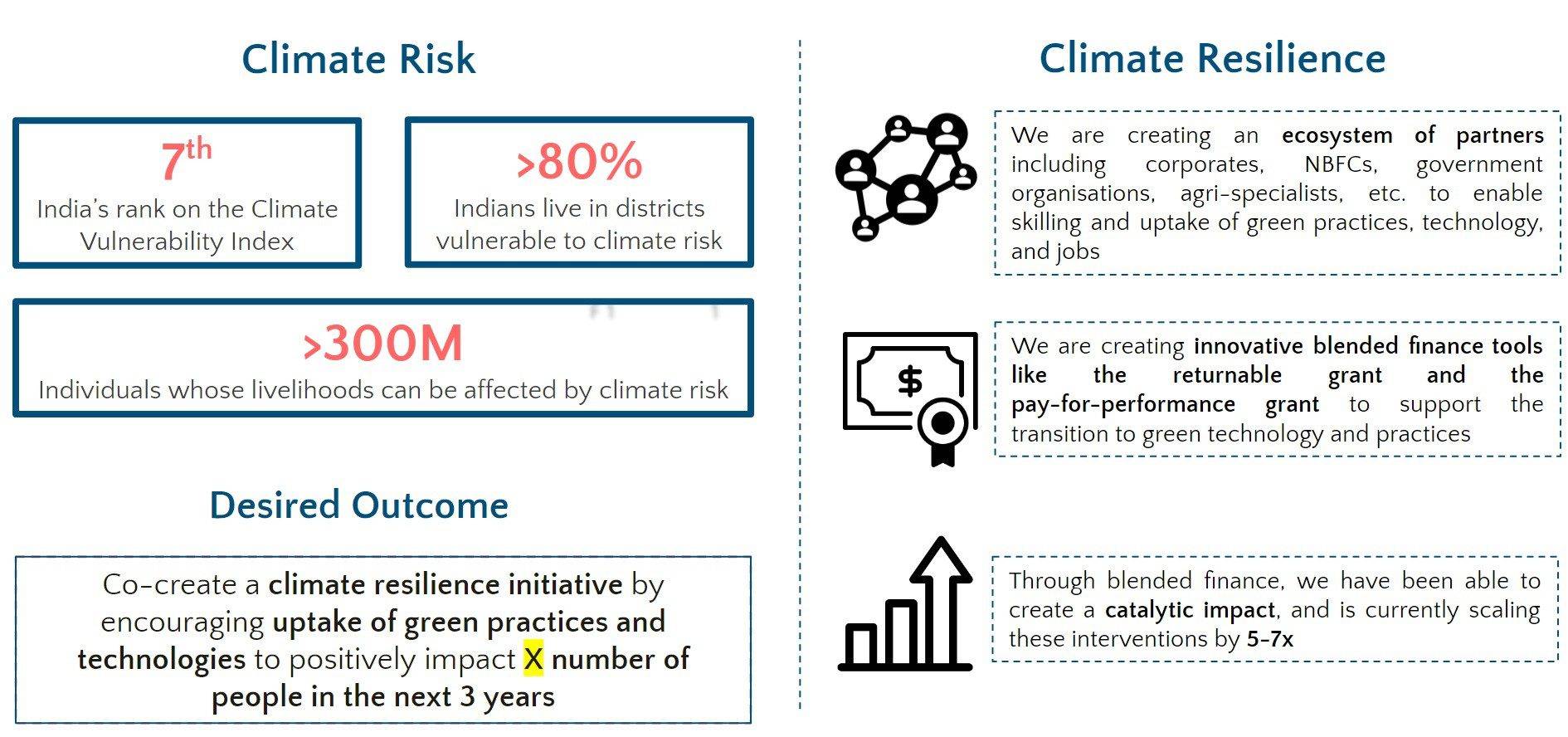

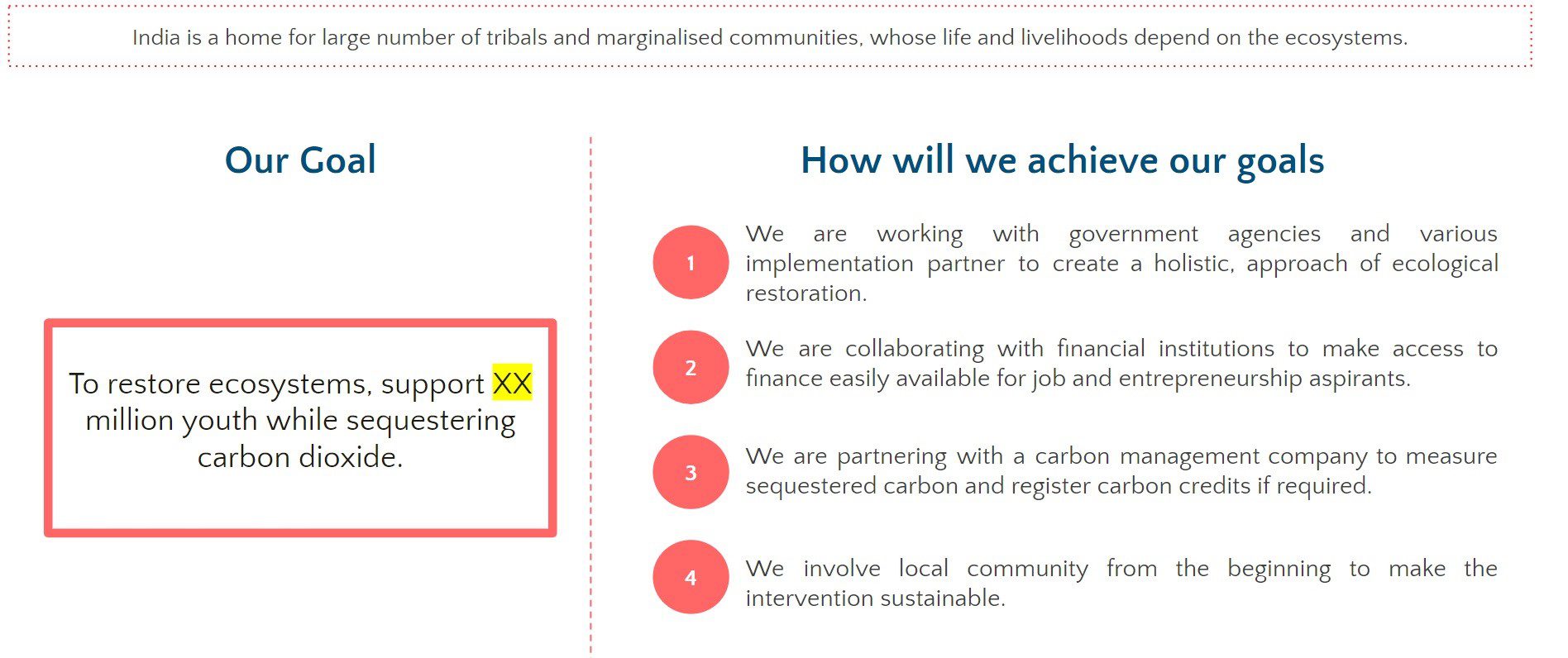

The COVID – 19 lockdown has adversely impacted the most vulnerable sections of society, such as informal workers, farmers, street vendors, gig economy workers, etc. Even among the sections of society hit the hardest, Persons with Disabilities (PwDs) have been among the worst affected due to an intersection of circumstances which include economic vulnerability, reduced mobility even in regular times and other hindrances which resulted from the lockdown.

Additionally, as entrepreneurs look to recover from these economic shocks, PwDs find it harder to obtain capital to start new enterprises or for working capital for existing enterprises. ATPAR is an organization that looks to create an enabling ecosystem for entrepreneurs with disabilities. ATPAR works with Entrepreneurs with Disabilities & their family members for their economic empowerment, social inclusion and rehabilitation by training them through NSIC Delhi on entrepreneurship development and mentoring them for 4 to 6 months to enable them to start, sustain and scale their entrepreneurial ventures.

ATPAR’s NEDAR (Network of Entrepreneurs with Disabilities for Assistance and Rehabilitation) provides business mentorship, handholding support, financial and market linkages to the entrepreneurs over and above the entrepreneurship development training. Many of these entrepreneurs needed financial assistance to restart business and recover from the economic impact of the pandemic.

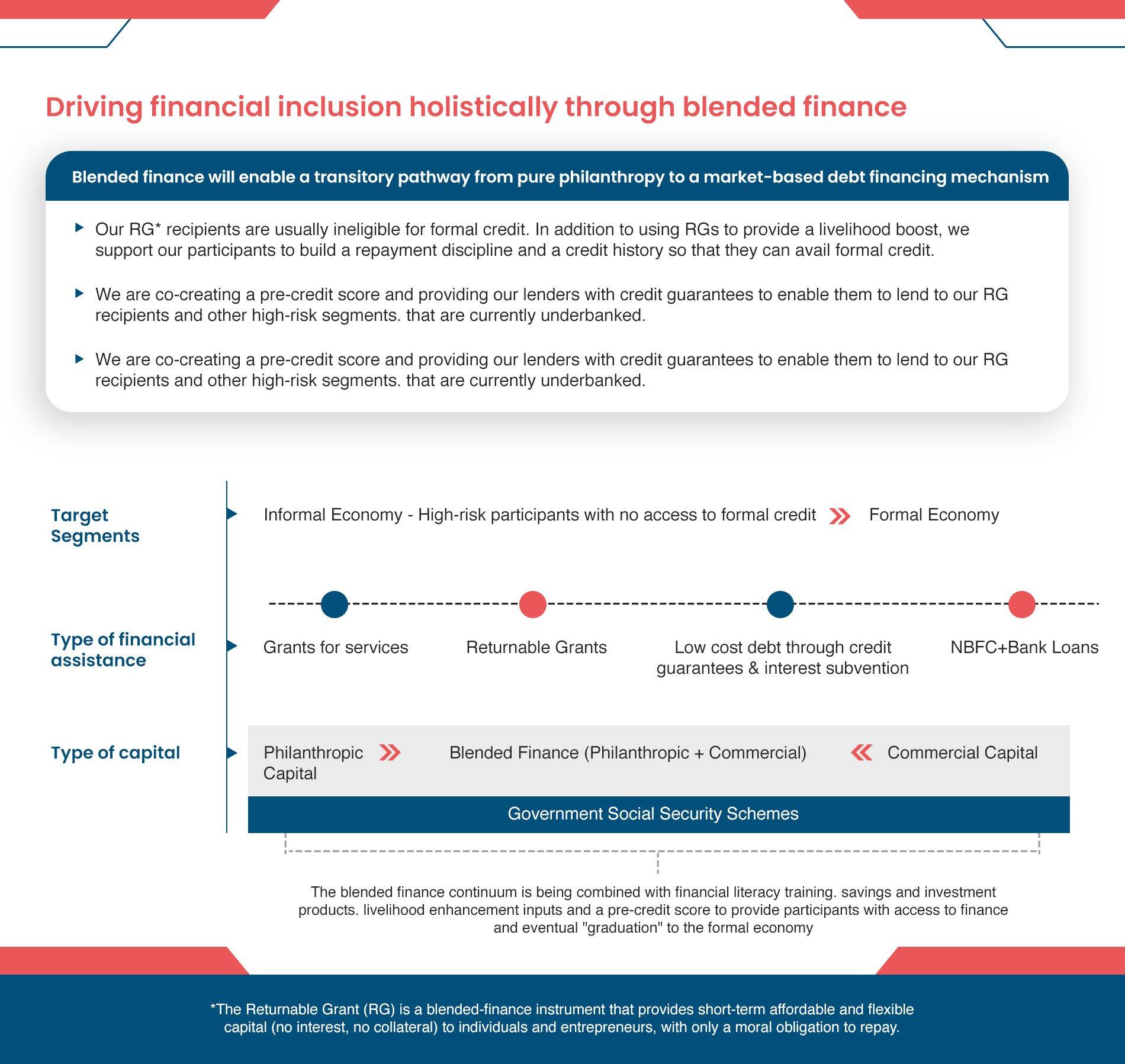

REVIVE has been working with 35 such entrepreneurs in Delhi – NCR, Jammu and Kashmir, Rajasthan, Uttar Pradesh, Bihar and Puducherry to provide financial assistance to fulfil their working capital needs, make asset purchases, etc. They have received zero – cost finance in the form of returnable grants (RGs) of INR 20,000 / 40,000 from REVIVE which would be repaid over the course of 1 year. The RG carries a moral obligation to repay as opposed to a legal obligation. During this period, all entrepreneurs will continue to receive ATPAR’s in-depth support through the NEDAR network as well.