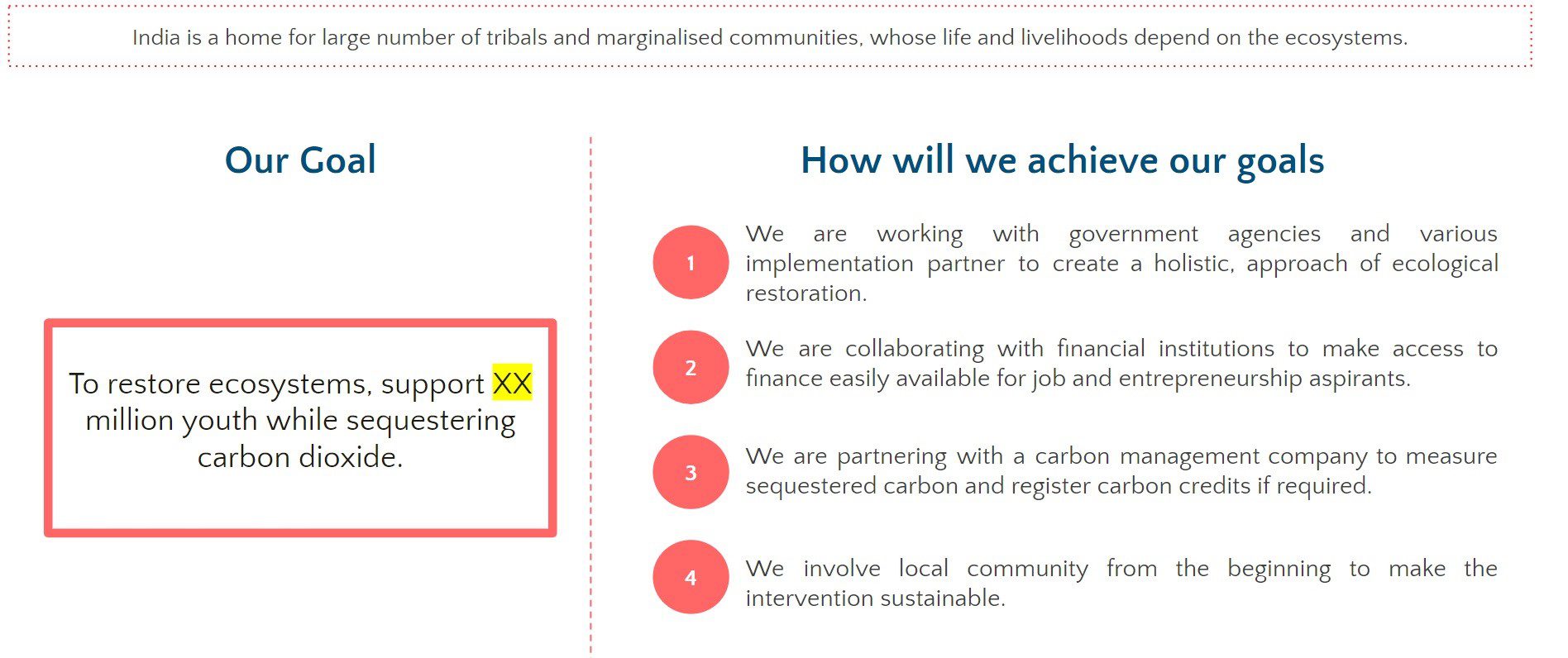

On January 22, 2021, the Ministry of Corporate Affairs amended the earlier CSR Rules of 2014 and notified the Companies (Corporate Social Responsibility Policy) Amendment Rules 2021, to make impact assessment mandatory for companies undertaking CSR activities and CSR expenditure above a specified threshold. The move aims to create accurate parameters in assessing the impact of CSR activities by shifting the focus from expenditure alone to impact assessment, and improve the quality of CSR projects while enhancing accountability and transparency.

This FAQ is a result of collaboration between Samhita & Centre For Advancement of Philanthropy. It has been written with the guidance of Noshir Dadrawala

Following are the answers to some of the most frequently asked questions (FAQs) about impact assessment:

Q1. What is the need for impact assessment?

Impact assessments help funders, grant-makers and companies to understand and evaluate the impact of their social investments in programmes and projects on their target beneficiaries or society. The findings of an assessment also help funders and companies to make evidence-based decisions in implementation and identify hurdles, allowing for programme continuity, scale, sustainability, efficiency, etc.

Q2. Do all companies need to conduct impact assessments?

According to the January 2021 amendment, impact assessment is mandatory for companies with a CSR budget of INR 10 crore or more in any fiscal year and all projects with outlays of INR 1 crore or more. These impact assessments must be undertaken by an independent agency.

However, it is suggested as best practise that impact assessment be undertaken for all projects as standard procedure,. Especially long term projects.

Q3. According to the new amendment, when must companies undertake impact assessments?

At least one year after programme implementation is complete.

Q4. If a company has a multi-year project, should the impact assessment be carried out after completion of the project?

Yes. As per Rule No. 8, if companies have multi-year programmes (say 3 years), impact assessment needs to be conducted after completion of three years of the programme. Additionally, a follow up assessment needs to be conducted one year after the completion of the programme to better understand the programme’s after effects.

However, if programmes are renewed or scaled up after each financial year, they would be treated as individual single year programmes, and separate impact assessments should be taken up every year.

Q5. Who can conduct an impact assessment?

Companies or their CSR initiatives cannot conduct impact assessments (selfassessment) on their own. An independent agency must be engaged for the assessment.

Q6. Is there a limit on the expense for undertaking impact assessment?

Yes, impact assessment related expenditure may be booked as a CSR expense as long as it does not exceed 5% of the total CSR spending or INR 50,00,000, whichever is less.

Q7. Is the limit applicable on the entire CSR budget or per project?

The limit is applicable on the total CSR budget of the financial year.

Q8. Will the cost for researchers/consultants/agencies be counted as part of the INR 50 lakh or 5% limit or can the spending be accounted for outside that?

Under the amended rules, “Administrative overheads” will now mean expenses incurred by the company for ‘general management and administration’ of Corporate Social Responsibility functions in the company but shall not include the expenses directly incurred for the designing, implementation, monitoring, and evaluation of a particular Corporate Social Responsibility project or programme.

Further, a Company undertaking impact assessment may book the expenditure towards Corporate Social Responsibility for that financial year, which shall not exceed five percent of the total CSR expenditure for that financial year or fifty lakh rupees, whichever is less.

Thus, in our opinion, cost for researchers/consulting is neither part of the INR 50 lakh cap, nor the 5% cap on Admin expenditure

Q9. Can a project conduct impact assessment prior to completion of one year (short duration project) or should it wait for one year? If done earlier, would it be counted as part of the compliance?

The project should have completed at least one year. If it is an on-going project of three years, it would make sense to study impact only on completion of three years.

If you have any queries, want to know how to undertake an impact assessment or connect with the Samhita Impact Assessment team, feel free to reach out to us at csr@wohla.samhita.org

To know more about the other 2021 CSR Amendments check out Samhita’s detailed FAQ.