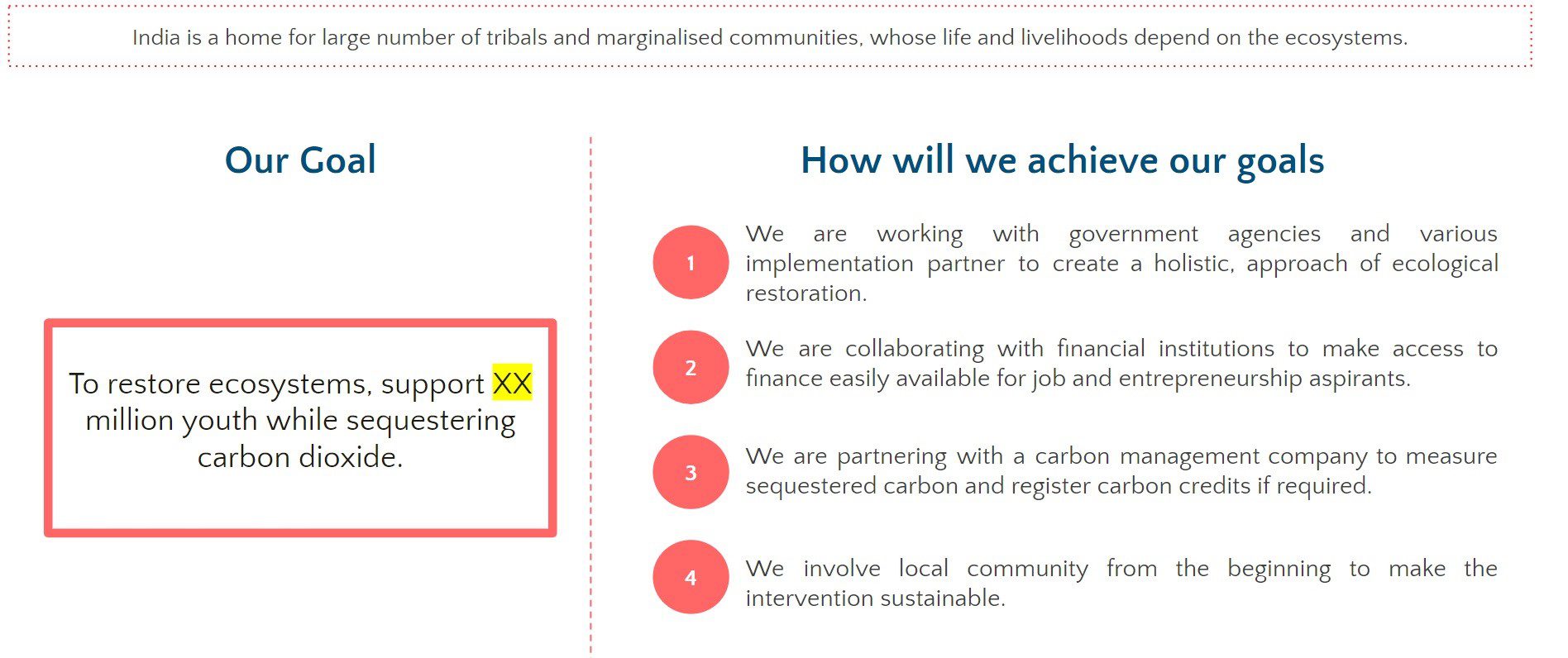

COVID-19 and the subsequent lockdown severely impacted artisans across the country. A KPMG study estimated that approximately 7.3 million people depend on handicraft and allied activities for livelihood. The handicraft and handloom sector in India is a Rs 24,300-crore industry and contributes nearly Rs 10,000 crore annually in export earnings.

According to a survey by Dun and Bradstreet, 82 per cent of 250 MSMEs that were surveyed, said that Covid-19 had hit them hard. A Reserve Bank of India report states that MSMEs are one of the five worst affected sectors in India. Artisans and weavers form even a smaller number within the industry that is largely unorganised.

Since the lockdown, artisans witnessed production come to standstill. Huge unsold inventory piled up, while sales opportunities through exhibitions and through orders either came to a stop or dwindled quite low. Added to that, they had no working capital to reinvest. Some of the artisans reported their savings drying up and not having enough to meet the daily expenses.

Most artisans have an important job of carrying forward and keeping alive the art. However, with so many additional problems during the pandemic, there were possibilities that many would look for alternative forms of livelihood.

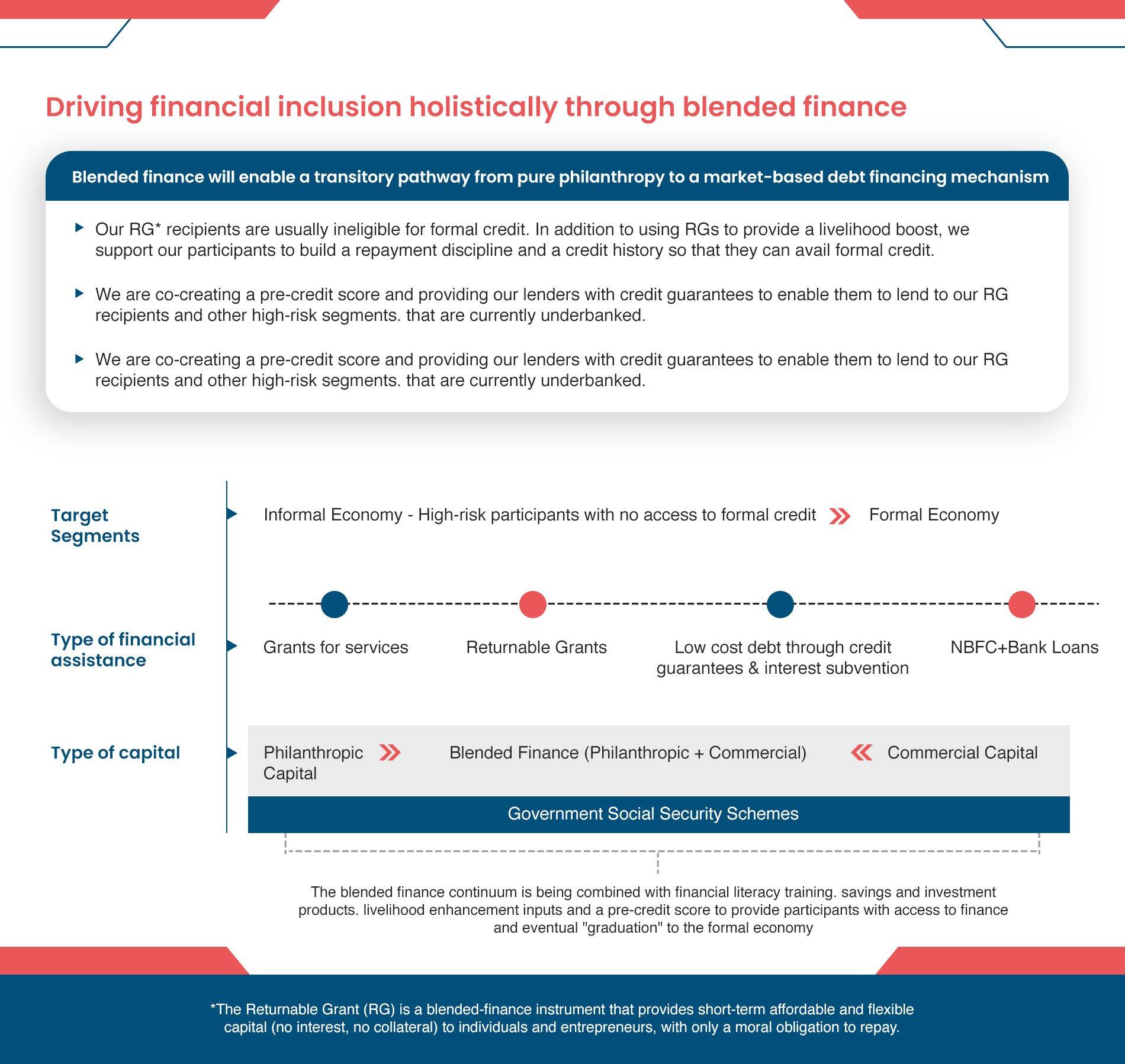

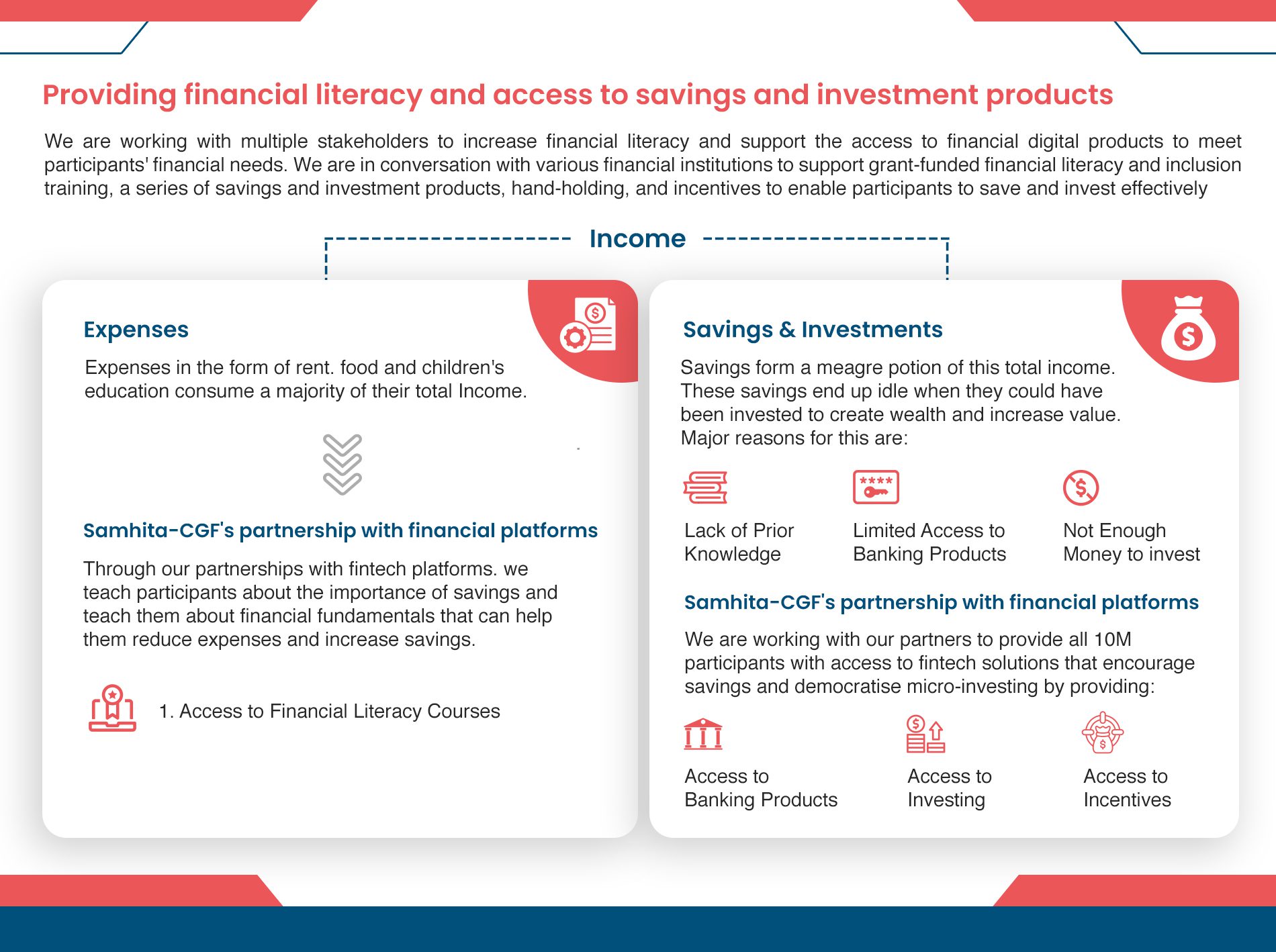

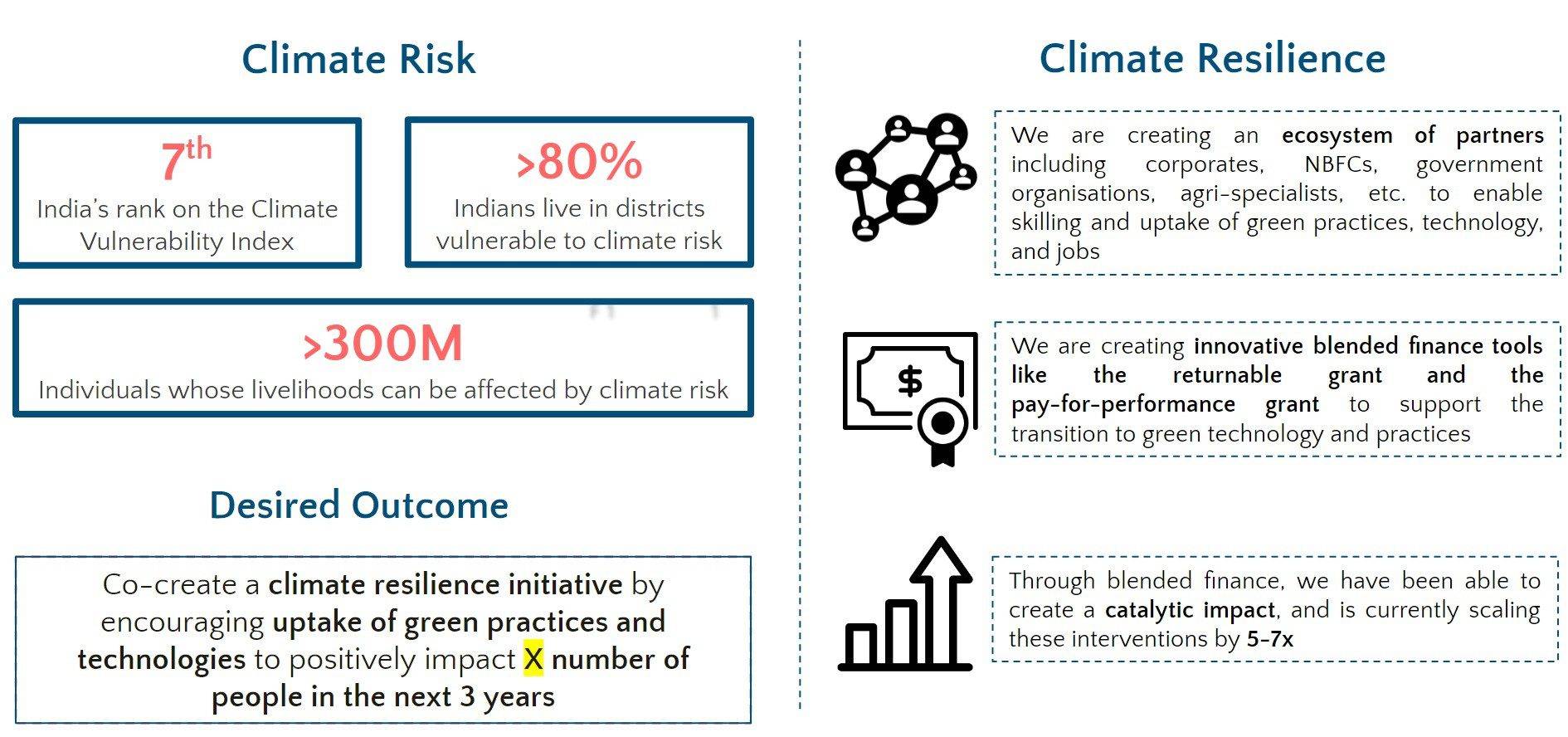

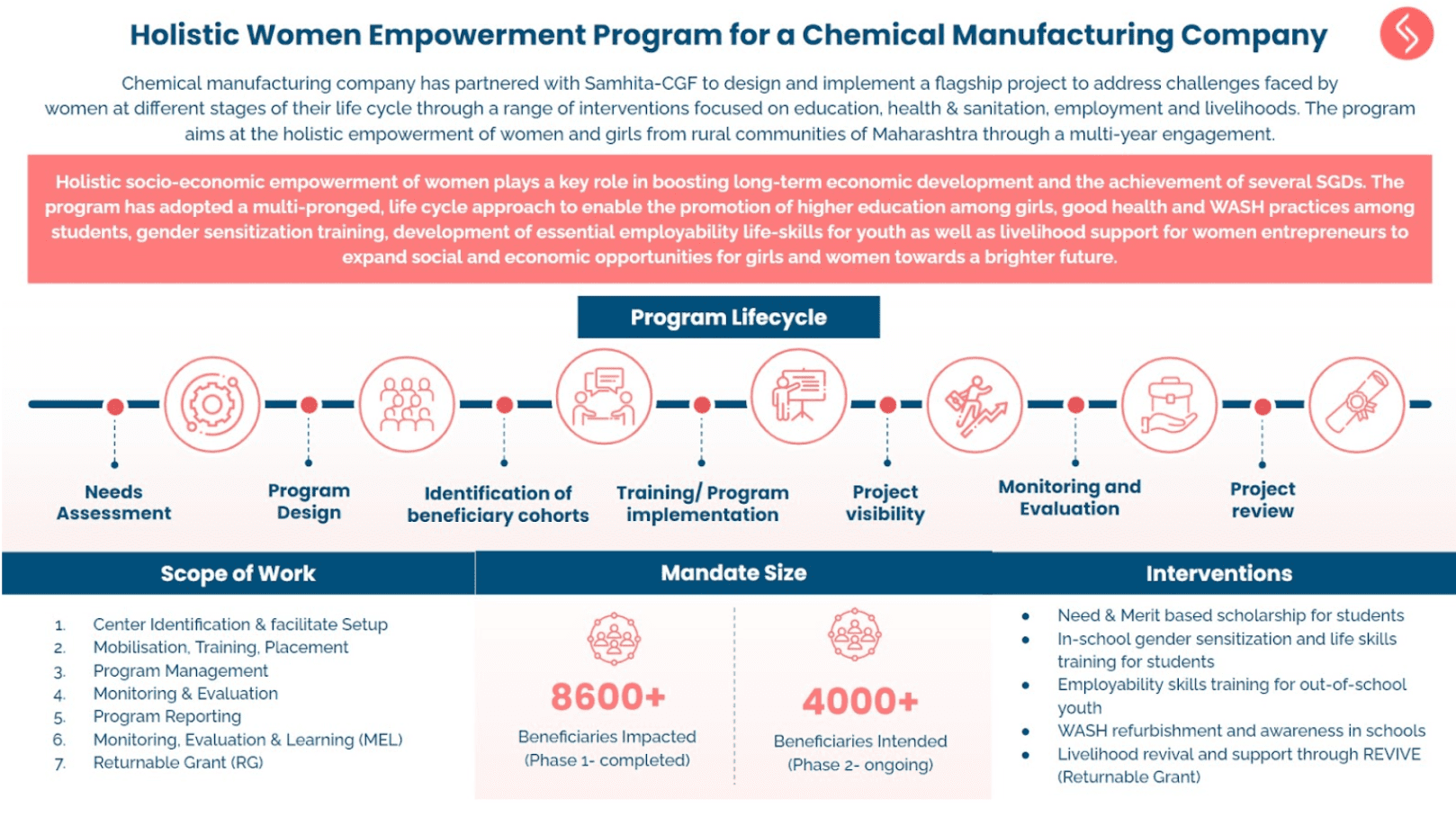

In order to revive these severely affected groups of artisans, Samhita-CGF with support from MSDF, S&P Global, and Vinati Organics, introduced Returnable Grants for women artisans. It is pertinent to mention that most of these women artisans are usually remotely located and spread across rural areas. Therefore, social enterprises take up the role of connecting these artisans, training them and skilling/upskilling them. It is also the enterprise’s role in such cases to source good quality raw materials and trains the artisans to produce high-quality products while simultaneously ensuring market linkages and sales.

Identifying the role of an enterprise in bringing together artisans and the subsequent impact they can have on the lives and livelihoods of these artisans, Samhita-CGF collaborated with social enterprises like TISSER and SEWA Trade Facilitation Centre (STFC) as an effort to revive their livelihood within the REVIVE Alliance.

The Returnable Grants have filled the gap of working capital for these enterprises. Once there was increased access to working capital, reinvestments in products and diversification into newer products like masks were undertaken by these enterprises. This also meant that slowly artisans could earn back their livelihood while upskilling themselves by making newer products. Products were specifically designed for festivals to increase the number of sales using the working capital given to these enterprises. Once the sales happen, the client money is revolved into the pool of returnable grants to impact more women artisans.

Within the REVIVE Alliance, nearly 1200 women artisans including warli and pottery in Maharashtra, and textile artisans in Gujarat are being supported. Not only did these women artisans witness an economic revival as the orders increased, but they also underwent training and capacity building workshops to enhance their skills and diversify their products. Their average earnings have started showing an upward trend of slow and steady increase.

Not only is the REVIVE Alliance supporting these social enterprises to enhance the lives of these women artisans, but are also safeguarding the traditional art of warli and pottery.

In addition, the REVIVE Alliance aims to protect producer artisans directly linked to its ecosystem. Producer artisans are upskilled through distance learning to enable them to start producing the “Karuna ” range of products from their homes. Karuna products include face masks with designs, wrist bands, dining table mats with embroidered stories, embroidered bookmarks, embroidered handkerchief, tassel, keychains, hangings, natural fiber wristbands, coasters, and trivets among others. Market linkages (online and offline) are also provided to sell these products and thus ensure continued livelihood for the artisans during and post the lockdown. The project is implemented by Greenkraft Industree in Tirunelveli, Tamil Nadu. So far, 400 women artisans have undergone the training programs. The project envisages improving the avenues for the financial stability of women artisans and providing them access to market and financial linkages.